"AN INVESTMENT IN KNOWLEDGE ALWAYS PAYS THE BEST INTEREST" BENJAMIN FRANKLIN

"AN INVESTMENT IN KNOWLEDGE ALWAYS PAYS THE BEST INTEREST" BENJAMIN FRANKLIN

Research Article - (2022) Volume 0, Issue 0

Received: Aug 16, 2022, Manuscript No. BSSJAR-22-71913; Editor assigned: Aug 19, 2022, Pre QC No. BSSJAR-22-71913(PQ); Reviewed: Sep 02, 2022, QC No. BSSJAR-22-71913; Revised: Sep 09, 2022, Manuscript No. BSSJAR-22-71913; Published: Sep 16, 2022, DOI: 10.36962/GBSSJAR/59.S1.001

Financial management is the overall arrangement for planning, directing, monitoring, organizing, and controlling of the economic resources of an organization, with a view to efficient accomplishment of the enterprise objectives. It is well recognized that financial management practice has a key reason for the success of those enterprises and it is the main issue for any business type. However, the status of effective financial management practice in developing countries especially in Ethiopia is at its infant stage. Thus, the main objective of the study is to investigate the determinants of financial management practice of micro and small enterprises in East Gojjam Zone. The type of research applied in this study is explanatory/causal/ in nature. Questionnaires were used to collect primary data. The combination of purposive stratified and systematic sampling techniques were applied to select respondents. A multiple linear regression model was used to test the casual relationship between the study variables. The findings indicated that financial management knowledge, financial management attitude, size of enterprise, locus of control, and use of information technology have positive and significant effect on financial management practice. However, gender, owner’s age, and enterprise age have no statistically significant effect on financial management practice of micro and small enterprises. The descriptive analysis indicated that there is poor financial management practice of micro and small enterprises in East Gojjam Zone. The study suggested that financial management experts should provide financial management training for micro and small enterprise owners/managers.

http://www.surgeryjournals.com/

http://www.surgeryinsights.com/

http://www.medicineinsights.com/

http://www.medicinaljournals.com/

http://www.medicalsci.org/

http://www.eclinjournals.com/

http://www.eclinicalsci.org/

http://www.eclinicaljournals.org/

http://www.eclinicalinsight.com/

http://www.clinicalres.org/

http://www.clinicalinsight.org/

http://www.clinicalmedicaljournal.com/

http://www.clinicalmedicaljournal.org/

http://www.tradescience.org/

http://www.pharmares.org/

http://www.pharmainsights.org/

http://www.epharmajournal.org/

http://www.epharmajournal.com/

http://www.nursingres.org/

http://www.nursingres.com/

http://www.healthcareres.org/

http://www.healthcareinsights.org/

http://www.enursingcentral.com/

http://www.enursingcare.org/

http://www.ehealthjournals.org/

http://www.ehealthjournals.com/

http://www.psychiatryres.com/

http://www.neurologyres.com/

http://www.neurologyinsights.org/

http://www.neurologyinsight.com/

http://www.managjournal.com/

http://www.emedscience.org/

http://www.emedicinejournals.org/

http://www.molbioljournal.org/

http://www.molbioljournal.com/

http://www.engjournals.com/

http://www.enginsights.org/

http://www.edentalcentral.com/

http://www.dentistryjournals.org/

http://www.dentistryinsights.org/

http://www.scitechjournal.org/

http://www.jscitech.com/

http://www.pulsusjournal.com/

http://www.peerreviewjournal.org/

http://www.peerreviewjournal.com/

http://www.peerreviewedjournals.org/

http://www.journalinsight.org/

http://www.escientificjournals.com/

http://www.escienceopen.com/

http://www.esciencejournals.org/

http://www.esciencejournals.com/

http://www.emedicalscience.com/

http://www.emedicalsci.org/

http://www.emedicalsci.com/

http://www.microbiologyres.com/

http://www.microbialjournals.com/

http://www.immunologyres.com/

http://www.immunologyinsights.com/

http://www.molecularbiol.com/

http://www.esciencejournal.org/

Determinants, Financial management, Micro and small enterprises, East gojjam zone.

Financial management practice is a global issue that increases the profitability of any business type. Financial management is the key instrument for success of any Business. Financial management is significant to the continuity of Small and Medium Enterprises (SMEs). The growing importance of this issue raises necessary questions whether companies are improving their abilities to have effective financial management and implementing changes that will enable them to analyze results, to interpret, to predict future performance and improve their business decisions (Barker 2003). Small and micro businesses are the driving force for the growth and development of the economies of many countries in the world including Ethiopia. It is also noted in various literatures that such contribution of the small scale enterprises to the economy become realistic only with effective financial management practice (Derbie and Kassahun 2013). Poor financial management skill of owners/managers is the main cause underlying the problems in small business financial management practice (Jindrichovska 2013). Small enterprises contribute greatly to the economies of all countries, regardless of their level of development (Abanis, et al 2013). In the world, small, medium and micro enterprises play a great role in absorbing labor, penetrating new markets and generally enhancing an enabling environment for entrepreneurship. This is partly due to the fact that small, medium and micro enterprises tend to be more labor-intensive and therefore have a higher labor-absorption capacity than big businesses (Jacqui and Macquet 2002). For instance, in the United States of America, small businesses introduce innovative products and services, created jobs, opened foreign markets and in the process sparked the US economy. In Japan, small businesses account for the bulk of the country’s established businesses that provide sustainable jobs. In Taiwan, small businesses account for 98% of the gross domestic product (Landzani 2004). In Africa, in order to improve the economic conditions and poverty issue, small businesses can play a greater role as the driving force of economic growth and poverty reduction (Okpara 2011). Any strategy for poverty alleviation in Africa must include support, encouragement and promotion of SMEs. For instance, in South Africa, 90% of new jobs were created by small, medium and micro-enterprises between 1985 and 2005 (Cohen 2012). In Ethiopia, micro and small enterprise sector has a great importance particularly for the low-income, poor and women groups which is evident from their relatively large presence, share in employment and small capital requirement. These are sufficient reason for governments and other stakeholders in development to be interested in micro and small enterprises. They are seen as means of providing employment, alleviating poverty, ensuring food security, and private sector development. However, in the context of many developing countries and countries in transition, particular in Ethiopia, MSEs are also seen as an emerging private sector, forming the basis for private-sector-led growth (Gebrehiwot and Wolday 2001). According to East Gojjam Zone SMEs office report (2019), in Amhara region specifically in East Gojjam Zone, Small and Micro enterprises have a great significance by creating a job opportunity and creation of wealth for more than 47,482 owners without including employees and other participants in five sectors including manufacturing, construction, service, trade and urban agriculture. Therefore, this indicates that Small and Micro businesses have significance contribution for the development of the economy and hence they have to exercise better financial management practice by identifying key determinants. Due to this fact, the researcher was motivated to investigate determinants of financial management practice of MSEs in East Gojjam Zone, Ethiopia.

Statement of the problem/Rational of the study

Sound Financial management practice has a great contribution for small and micro enterprises all over the world. That is why financial management practice improves the performance of any business. Financial management knowledge becomes an increasingly valuable skill for any decisions making practice in the 21st century economy. As pointed out that financial management is important for any institutional success whereas ineffective financial management, combined with other factors in an organization can often lead to severe problems (Lakew and Rao 2012). To run a successful business, a manager needs a wide range of small business management skills including finances (Urban and Naidoo 2012). However, Prior studies on the management of small and medium industries advocate that even management functions such as planning, organizing, staffing, directing, and controlling are not done properly in many of such industries. That is why many small and medium industries financial management practice is very poor. Lack of sufficient knowledge and experience of managers, failure in selection of the staff on the basis of meritocracy, non-dedication of responsibilities to members, insufficient commitment of managers and lack of access to information, failure in proper processing of information, and so on are the major reasons for these barriers (Asil and Naralan 2016). MSEs are also poorly managed due to the lack of management skills among owners or managers. They lack awareness of the importance of adopting business best practices and quality management systems, such as financial management and customer focused activities, in order to increase the firms’ productivity and profitability. As a result, inefficient SMEs are unable to compete effectively in the market impacting the entire SME sector performance (Radam, Abu and Abdullah 2008). Further, many small and micro enterprise owners fail because they are unable to understand basic financial concepts or practices. Even in developed countries, entrepreneurs have not sufficient financial management skill, an issue which is obvious in the small business and enterprise world. It’s widely perceived that throughout the world, small businesses have a high rate of failure. In the U.S Small Business Administration had noted that fifty percent (50%) of small businesses fail in the first year and ninety-five percent (95%) fail within the first five years (European Federation of Accountants, 2004). Harif et al. did a research on the financial management practices of SMEs in Malaysia and the result indicated that lack of working capital which accounted for 93.6 per cent is the most common weakness in the area of financial management practice. The issue of financial management in developing countries is not so much satisfactory. Especially in Ethiopia, financial management practice is at very severe level. This is because most business enterprises have not appointed financial managers to be in charge of financial management of the company. Usually, the owners or general managers act as the assistance of the accountant control financial matters of the company. On the other hand, most owners/managers have no formal training in management skills, especially financial management. In addition, the concepts of financial management have also only been recognized in Ethiopia since the beginning of the 1960s, when the commercial code was introduced by the then imperial government. Hence, financial management is still one of the challenges of business enterprises in Ethiopia (Deresse and Rao, 2012). Additionally, in Ethiopia, specifically in Woliso town, Oromia region, Solomon ( 2017) in his study pointed that the owners of small businesses have no adequate financial management skills and training, most small businesses do not engage in financial planning, analysis, and control; do not set short and long term financial objectives; do not analyze the trend in sales, cost and profit. His finding further stated that lack of awareness and knowledge, lack of follow up and inability to maintain qualified accountants are the major factors that hinder to adopt best financial management practice. Therefore, the main objective of the study was to investigate determinants of financial management practice of micro and small enterprises. The following are basic research questions for this study

1. What seem like the financial management practice of MSEs of East Gojjam Zone?

2. What are the problems faces in financial management practice of MSEs of East Gojjam Zone?

3. How study factors affect the financial management practice of MSEs of East Gojjam Zone?

Objectives of the study

General objective of the study: The general objective of this study is to investigate determinants of financial management practice of Micro and Small enterprises in selected woredas of East Gojjam Zone.

Specific objectives of the study:

The study has the following specific objectives.

1. To assess the extent of financial management practices of MSEs of East Gojjam Zone

2. To identify problems that face in financial management practice of MSEs in East Gojjam Zone.

3. To examine how study factors affect financial management practice of MSEs in East Gojjam Zone.

Significance of the study

This study has great significance to micro and small enterprise owners, community service providers, policy makers, other researchers in the study area, and the current researcher.

To MSE owners/managers: This study provides initiations for knowing financial management practices, identifies factors that affect their financial management practice and provides possible recommendations about how to enhance financial management practice in enterprises.

To community service providers: This study has used to identify factors that affect financial management practices of small and micro enterprise with respect to their positive or negative influence and also identifies gaps of financial management of micro and small enterprises in East Gojjam Zone. This is best for community service providers to provide financial management trainings and other expert supports such like advises.

To policy makers: This study provides important issues about determinants of financial management practice and the policy makers and the relevant government bodies will gain knowledge on how to handle financial management problems and used the study as a bench mark. Therefore, in order to making sound regulations and policies with respect to financial management practice, this study has a great significance.

To future academicians/researchers: This study used as an input to research institutions and the academicians who want to advance the knowledge or will do further on the same study area.

To the current researcher: this study has two advantages for the researcher of this study. First, it increase the knowledge of the researcher about the factors that affect financial management practice by reading different theories/literatures, researches, articles and so on and also give knowhow about financial management practice of MSEs of East Gojjam Zone. Second, it is used for partial fulfillment of the award of MSc in accounting and finance.

Scope of the study

The scope of this study is delimited on conceptually, geographically and methodologically as follows:

Conceptually: This study was concentrated on determinants of financial management practices (working capital management, fixed asset management, financial planning and control as well as financial reporting and analysis) in MSEs of selected woredas of East Gojjam Zone.

Geographically: This study was specifically be carried out in East Gojjam Zone Amhara region which is located on the North Western highlands of Ethiopia at a geographical location of 100 1`46`` and 100 35`12``N latitudes and 370 23` 45`` and 370 55` 52``E longitude and at a distance of 305 and 251km from Addis Ababa and Bahir Dar respectively.

Methodologically: The study was employed mixed (qualitative and quantitative) research approach and respondents of this study were owners/managers of micro and small enterprises in selected woredas of East Gojjam Zone. The study was used only primary data and both descriptive and multiple regression analysis methods were employed.

Financial management knowledge

Financial management knowledge is the capability to use relevant knowledge and understanding to planning, organizing, directing and controlling or manage the financial activities of an enterprise such like utilization of resources (Lusardi and Mitchell, 2007). Further, The Bank association of South Africa has attempted to define SME financial literate managers as entailing the following qualifications: having adequate level of entrepreneurial competencies, personal skills, and business management skills, having appropriate level of understanding of functional financial management systems, has appropriate level of understanding of SMEs life cycle funding and other financial requirements, understand legal, regulatory and tax issues as they relate to financial matters and understand the range of legal resources it can opt to when necessary, in case of bankruptcy or other financial distress situations (Monticone and Messy 2012). As indicated that financial knowledge is a factor that has an impact on financial management practice (Eagly and Chaiken 1993). Further, research indicated that financial knowledge has a significant positive effect on financial management behavior because the role of education with the seminars of financial knowledge will increase insight about financial management behavior (Thi, et al 2015). Therefore, in this study, it was hypothesized.

H1: Financial management knowledge has significant effect on financial management practice.

Financial management attitude

Financial management attitude is defined as a state of mind, opinion and judgment of a person about financial management (Jodi and Phyllis 1998). Financial attitude can be considered as the psychological tendency expressed when evaluating recommended financial management practices with some degree of agreement or disagreement (Parrotta and Johnson 1998). Financial attitudes shape the way people spend, save, hoard, and waste money (Furnham 1984). On the same case, when tested the impact of financial attitudes on financial management by setting attitudes as an independent variable, found that a positive attitude toward planning was the greatest predictor of cash flow management (Godwin 1994). People with stronger perceptions and positive financial attitudes tend to more successful in financial management (Joo and Grable 2004). Contrarily, states that the financial attitude has a significant negative effect on financial management which means someone has a good financial management attitude but bad in financial practice (Rejina, et al 2011). Thus, in this study, it was hypothesized:

H2: Financial attitude has significant effect on financial management practice.

Locus of control

According to locus of control is defined as the extent to which individuals believe that they can control events which affect them (Hellrigel, et al 2010). A research on a title factors affecting personal financial management behaviors evidenced from Vietnam and the study indicated that locus of control has a significant negative effect on financial management behavior (Thi, et al 2015). By contrast, on his study found that the better locus of control a person has, the better pattern of financial management behavior is caused by internal locus of control is more important because individuals who are more careful and control its expenditure in accordance with the needs so as not to spend money on every month and can be said that the locus of control have a significant positive effect on financial management behavior (Listiani 2017). Exceptionally, Ida and Dwinta indicated that the locus of control has no relation to financial management practice. Therefore, in this study, it was hypothesized:

H3: Locus of control has significant effect on financial management practice

Use of information technology

Use of Information Technology defined as usage of tools and machines used to solve real world problems. A computer is a programmable machine that responds to a specific set of instructions in a well-defined manner and can execute a pre-recorded list of instructions (Gupta 2008). According to (Ashrafi and Murtaza 2008), ICT refers to a wide range of computerized technologies that enables communication and the electronic capturing, processing, and transmission of information. These technologies include desktop computers, laptops, hand-held devices, wired or wireless connectivity, business productivity software, data storage & security, network security, other related protocols, etc. ICT has the ability to enhance, coordinate and control the operations of many organizations and can also increase the use of financial management. According to (Bharadwaj 2000) the use of technological at firm level reckoned to have positive impact on firm practices. According to (Berisha 2009), the use of information technology by SMEs can benefit them by developing competences for managing, information intensive resources, reduce the transaction costs and develop capability to gather information locally and internationally resulting into rapid flow of information. Buhimila and (Dong 2018) asserted that there is a significant results on the impact of use of technology and firm financial management practices. Adoption and actual use of more sophisticated information technology in developing countries would have a cunningly better way of SMEs financial management practices and performance. The use of computerized accounting system as a major factor in promoting sound financial management system (McChlery, et al 2005). In addition, The inability of small firms to make use of computerized accounting systems also act as a barrier to the successful implementation of sound financial management practices (Agyei-Mensah 2011). Therefore, in this study, it was hypothesized that:

H4: The use of information technology has significant effect on financial management practice.

Size of enterprise

According to Pandey, 2012 enterprise size can be defined in a number of ways such as amount of capital invested, number of employees, the technology used in the operation and its market coverage. Size of Enterprise refers to employees per establishment, employees per company, sales per firm and value added per firm or total assets of the enterprise. The size of SME affects the competitiveness of the firm as well as the operation of the enterprise. The larger the Enterprise size, they acquire better resources, economies of scale, able to have advanced equipment’s, knowledgeable employees, and others. In the opposite, the smaller the Enterprise size, limited access to capital, low number of employees, has no that much advanced technology and so on. Study determined that there is statistically significant differences between the category of small and medium scale SMEs in adopting accounting, cash management practices and fixed asset management practices (Rathnasiri 2015). Also, indicated that the need to prepare a complete set of financial statements increases as an entity progresses from small to medium size (Everaert, et al 2006). It is at the medium-size stage that financial performance reporting will be useful to internal and external users. Therefore, the hypothesis is formulated as:

H5: Enterprise size has significant effect on financial management practice.

Age of enterprise

Age of Enterprise is defined as the number of years of the establishment of the business enterprise. Wambui, Kimani, and Muhavani (n.d) were studied on a title“Determinants of effective financial management in catholic church managed health institutions in kenya”.The results indicate that institutional age and effectiveness of financial management are positively and significantly associated. By contrast (Rathnasiri 2015) concluded that the number of years that business has been operating under existing management is not a significant variable for varying adoption of financial management. Thus, the hypothesis is formulated as:

H6: Enterprise age has significant effect on financial management practice.

Age of the owner

Age of owners refers to the number of years the owner have starting from born. In their study on a title Adoption of Financial Management Practices indicated that owner’s age has significant positive effect on financial management practice (Elizabeth, et al 1998). They indicated that the older the participant, the greater the number of financial management practices adopted. By contrast (Asandimitra and Kautsar 2017) indicated in their study that age has negatively significant impact on the success of SMEs management by women entrepreneurs in East Java. It happens because the age of women entrepreneurs is dominated by youth. It shows that the younger women entrepreneurs, the more success in managing the SMEs. Thus, the hypothesis is formulated as:

H7: Owner’s age has significant effect on financial management practice.

Gender

The other demographic factor is gender; gender is defined as range of characteristics given to human beings as male and female. A study done by (Fatimah-Salwa, et al 2013) on a title success factor of successful microcredit entrepreneur’s empirical evidence from Malaysia indicates that there is significant relationship between gender and financial management practices. This means the males are better financial managers than the female practitioners. On the other hand (Hira et al 1992 and Johnson 1998) found that no relationship between gender and financial management. This means that gender has no influence on financial management practice of SMEs. Thus, based on the findings from majority of previous works, in this study it was hypothesized that:

H8: Gender has significant effect on financial management practice

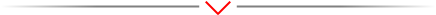

Conceptual framework

A conceptual framework is a research tool intended to assist a researcher to develop awareness and understanding of the situation under review. It shows the interaction of variables both independent and dependent variables. The independent variables are those factors (Financial management knowledge, financial attitude, locus of control, Enterprise size, Enterprise age, use of information technology (computer), owner’s age and gender which affect financial management practice in SMEs and the dependent variable is financial management practice (Fig. 1).

Fig 1. Conceptual Framework of the Study.

Research methodology

Research design: The research design used in this study was explanatory because explanatory research aims at establishing the cause and effect relationship between variables.

Total population: The total populations of Micro and Small Enterprises of East Gojjam Zone in 20 woredas (Aneded, Awabel, Baso Liben, Bibugni, Debay Telat, Debre Elias, Debre Markos, Dejen, Enarj Enawga, Enbsie Sar Midir, Enemay, Goncha, sede, Gozzamn, Hulet Eji Enesie, Machakel, Shebel Berenta, Sinan, Bichena and Motta) are 47,482 in the year 2019. There are 27,989 micro and small enterprises in the selected six weredas (Debre Markos, Sinan, Motta, Bichena, Gozzamn, and Debre Elias) in the year 2019 (Table 1). Therefore, Total population from each selected woredas with respect to their Business sectors is presented as follows:

| Woreda | Sectors | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Manufacturing | Construction | Service | Trade | Urban Ag. | |||||||

| Micro | Small | Micro | Small | Micro | Small | Micro | Small | Micro | Small | Total | |

| D/Markos | 833 | 95 | 1977 | 82 | 1287 | 283 | 1978 | 19 | 502 | 30 | 7086 |

| Sinan | 169 | 1 | 279 | 0 | 580 | 12 | 917 | 24 | 1005 | 0 | 2987 |

| Gozzamn | 192 | 5 | 665 | 0 | 583 | 35 | 549 | 18 | 4210 | 17 | 6274 |

| Motta | 390 | 60 | 954 | 42 | 674 | 52 | 2085 | 65 | 116 | 38 | 4476 |

| D/Elias | 220 | 15 | 410 | 30 | 334 | 37 | 580 | 69 | 2567 | 0 | 4262 |

| Bichena | 330 | 11 | 382 | 2 | 499 | 34 | 1529 | 38 | 79 | 0 | 2904 |

| Total | 2134 | 187 | 4667 | 156 | 3957 | 453 | 7638 | 233 | 8479 | 85 | 27989 |

Table 1. Total population from each woreda by sector.

Sampling technique

The study was used a combination of stratified sampling method (makes the strata based on type of business they were engaged (manufacturing, construction, service, trade and urban agriculture), systematic sampling technique (used to select respondents from each stratum’s) and Purposive (to select six woredas from 20 woredas of East Gojjam Zone). The selected six woredas include: Debre Markos, Sinan, Motta, Bichena, Gozzamn, and Debre Elias. This woredas are selected because of the existence of large number of MSEs as compared to others in the Zone.

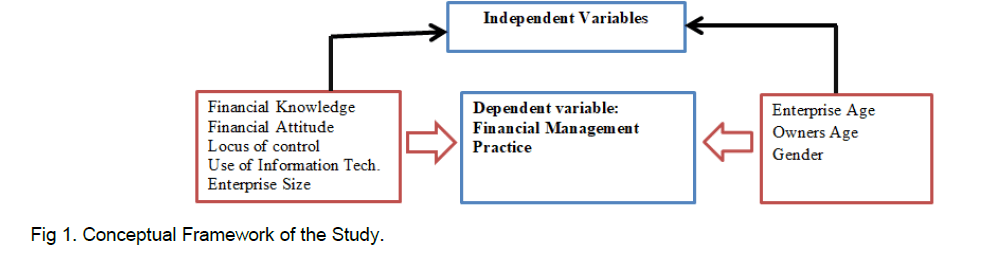

Sample size determination

The researcher found sample size (n) from the total population at 95% confidence level by using the formula of Yemane (1967), which is a simplified and famous formula used by a number of researchers.

Where, N= Population size, e= sampling error

To calculate and determine the sample from each stratum, the researcher was used the proportional allocation, in which a sampling fraction in each group is used i.e. proportionate to the total population, sample size in stratum one is equal to total sample size divided by the total population and multiplied by the total population of the specific stratum (Crawford, 1990) (Table 2).Therefore, the researcher was determined a sample size from each stratum as follows:

where, p=proportion

| Woreda | Sectors | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Manufacturing | Construction | Service | Trade | Urban Ag. | |||||||

| Micro | Small | Micro | Small | Micro | Small | Micro | Small | Micro | Small | Total | |

| D/Markos | 11 | 1 | 27 | 1 | 18 | 4 | 27 | 1 | 7 | 1 | 98 |

| Sinan | 2 | 1 | 4 | 0 | 8 | 1 | 12 | 1 | 14 | 0 | 43 |

| Gozzamn | 2 | 1 | 9 | 0 | 8 | 1 | 7 | 1 | 58 | 1 | 88 |

| Motta | 5 | 1 | 13 | 1 | 9 | 1 | 29 | 1 | 2 | 1 | 63 |

| D/Elias | 3 | 1 | 5 | 1 | 4 | 1 | 8 | 1 | 36 | 0 | 62 |

| Bichena | 5 | 1 | 5 | 1 | 6 | 1 | 21 | 1 | 1 | 0 | 40 |

| Total | 28 | 6 | 63 | 4 | 53 | 9 | 104 | 6 | 118 | 3 | 394 |

Note: From the above table, n= N*p where, N= Total population from each strata and p= proportion i.e. n/N.

Table 2. The actual sample size of each woreda by sector.

Source of data and method of data collection

The study was used only primary sources of data and the primary data was collected through open and close ended questionnaires from micro and small enterprise owners/managers of East Gojjam Zone. The items in the questionnaire were mainly adopted from previous empirical studies with some modifications (Addo, 2017; Marris, 2005 and Rejna et al., 2011). In order to improve its reliability, the questionnaire was converted from English version to Amharic version and then distributed those questionnaires to respondents.

Method of data analysis

After data was collected from primary data sources through close and open ended questionnaires, in order to examine the effect of explanatory variables on financial management practice, the data have been analyzed by using multiple linear Regressions analysis and STATA version 13 was used as a data analysis tool. This is because multiple regression analysis is useful in determining whether or not a particular effect is present, in measuring the magnitude of a particular effect and in forecasting what would be of a particular effect (McCartney et. al., 2006). To analyze Likert scale questionnaires, first of all, it is necessary to calculate a composite score (sum or mean) from four or more Likert items and then the study used parametric statistic such as mean for central tendency, standard deviation for variance and regression (Boone and Boone, 2012).

Model specification

The study was used multiple linear regression model (OLS) and the estimated regression equation for this study is formulated using the equation below:

FMP= β0+β1FMK+β2FMA+β3LC+β4UIT+β5ES+ β6GEN+ β7OAGE + β8EAGE+ε

Where, FMP: Financial management practice; FMK: Financial management Knowledge; FMA: Financial Management Attitude; LC: Locus of control; UIT: Use of Information Technology; ES: Enterprise size; GEN=: Gender; OAGE: Owners Age; EAGE: Enterprise age; β0: constant term; ε: error term and β1, β2, β3, β4, β5, β6, β7 and β8 are beta coefficients of FMK, FMA, LC, UIT, ES, GEN, OAGE and EAGE respectively.

Definition and measurement of variables included in the model

Financial management practice is Systems of efficient and effective management of resources in such a manner as to accomplish the objectives of the organization (Chung and Chuang 2010). Financial management practice is measured using Likert scale (1-not practiced to 5-very highly practiced). First of all create Likert scale items and then calculating mean (continuous variable).

Financial management knowledge is the capability to use relevant knowledge and understanding to planning, organizing, directing and controlling or manage the financial activities of an enterprise such like utilization of resources (Lusardi and Mitchell 2007). Financial management knowledge is measured using Likert scale (1-strongly disagree to 5-strongly agree).

Financial management Attitude is defined as a state of mind, opinion and judgment of a person about financial management (Jodi and Phyllis, 1998) and measured by using Likert scale (1-strongly disagree to 5-strongly agree).

Locus of Control is defined as the extent to which individuals believe that they can control events which affect them (Hellrigel, et al 2010) and measured using Likert scale (1-strongly disagree to 5-strongly agree).

Use of Information Technology defined as usage of tools and machines used to solve real world problems. A computer is a programmable machine that responds to a specific set of instructions in a well-defined manner and can execute a pre-recorded list of instructions (Gupta 2008) measured using Likert scale (1-strongly disagree to 5-strongly agree)

Size of Enterprise refers to employees per establishment, employees per company, sales per firm and value added per firm or total assets of the enterprise and measured by Logarithm of total assets.

Gender is defined as range of characteristics given to human beings as male and female (dummy variable or Nominal scale 0 for male and 1 for female)

Age of Enterprise the number of years of the establishment of the business enterprise measured in number of years in operation (continuous variable).

Age of owners refers to the number of years the owner have starting from born and measured by Nominal scale (1 for 18 to 30 years, 2 for 31 to 45 years, 3 for 46 to 65 years and 4 for above 65 years).

Descriptive analysis result

The study addressed the challenges/problems of financial management practice of micro and small enterprises of East Gojjam Zone. Therefore, the survey result indicated that there was no adequate training given for owners/managers of enterprises, there is an absence of follow up and expert support about financial management in the zone of East Gojjam, there is a problem of over and under spending of money, there is a record keeping problem of transactions, there is inadequate and incompetent accountants, there is lack of proper planning of resources, there is a problem of pricing goods and services reasonably, there is a problem of segregation of duties, there is a problem of conducting internal audit, and there is a problem of preparing, analyzing and distributing financial statements.

In addition, the extent of financial management practice of enterprises was addressed in this study. The descriptive analysis part shows that majority of micro and small enterprises were not active at financial management practice. Which implies the extent of working capital management, fixed asset management, financial planning and control (management accounting), and financial reporting and analysis were not so much attractive. The survey result indicated that there is low cash management practice such like majority of enterprises do not carry out daily cash reconciliation, lack of internal control over cash, absence of using bank account for the enterprise, face difficulties in identifying future cash surplus and deficits. The extent of account receivable management indicated that there is an absence of recording receivable balances, not collecting receivables on time; there is no regular review of receivable balances and bad debts and also there is no techniques/methods used to collect receivables on time by majority of micro and small enterprises. Moreover, the extent of inventory management indicated that there is no recording of inventory balances, there were no physical count of inventory, there is an absence of physical safeguard of inventory against theft, fire and other damages. However, majority of enterprises were purchase/sale goods or services based on their decisions and authorizations. Besides, the extent of account payable management show that majority of enterprise were borrow money based on their capacity to pay, not borrow money any time if it is available which implies that majority of enterprise borrow money at the time of money deficit in their enterprise. However, majority of enterprises do not paid their debts on time. Extent of fixed asset management indicated that fixed assets are not recorded, not carry out physical count of fixed assets, fixed assets were not used for the maximum appropriate objective, repair and control of fixed assets were not maintain regularly. Extent of financial reporting and analysis indicated that transactions are not recorded immediately; financial statements were not prepared, analyzed and reported regularly, accounting practice principles (GAAP or IFRS) were not applied by majority of micro and small enterprises.

The result indicated that the extent of financial management knowledge of owners/managers as follows: majority of micro and small enterprise owners/managers have no enough knowledge about the policy and procedures of fixed asset management, not aware about the interest charged by banks and pay to depositors, not understand the balance of bank statements, no ability to prepare and analyze financial statements, no ability to prepare a business plan,. However, majority of respondents have know-how about minimizing spending too much and about where and how to invest business money but they have no enough/sufficient financial management knowledge.

The finding show that majority of respondents have good attitude about written budget absolutely leads to successful financial management practice, good attitude about the need to record transactions daily, good attitude about written financial goals help to determine priorities in spending, good attitude about planning for spending is essential to successful financial management practice. However, majority of respondents do not worry about the amount of money deposited per day/week; they do not worry about the length of time it will take to pay off debts; they do not worry about making financial statement analysis; do not worry about working capital management, and fixed asset management. Moreover, the study indicated that majority of enterprises do not use information technologies to record transactions, to prepare, analysis and distribute financial statements. In general, enterprises do not used information technologies for effective financial management practice.

Inferential analysis/model result

Diagnostic tests: The primary assumptions reviewed in this study include normality, homoscedasticity, multicollinearity, and model specification test. When assumptions are violated accuracy and inferences from the analysis are affected (Antonakis and Dietz 2011). Accordingly, the study was tested the following assumptions:

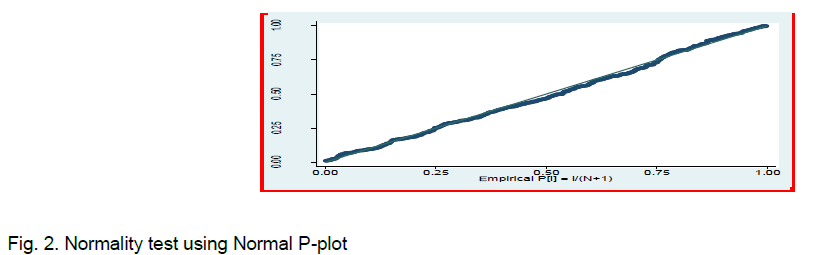

Normality test: The assumption of normality can be tested in different ways such as histogram, kdensity (kernel density estimate), normal p-plot, Q-plot, skewness and kurtosis. But, P-plots are more exacting methods to spot deviations from normality, and are relatively easy to interpret as departures from a straight line (Keith 2006). Therefore; the researcher was checked normality of residuals by normal P-plots and as indicated from Fig. 2, the data is normally distributed.

Fig 2. Normality test using Normal P-plot

Multicollinearity test: The data must not show multicollinearity, which occurs when there exist two or more independent variables that are highly correlated with each other. The researcher was checked this assumption in Stata through an inspection of correlation coefficients or Tolerance/variance inflation factor (VIF) values. As a rule of thumb, multicollinearity problem exists if the VIF of a variable exceeds or equal to 10 (Table 3).

| Variable | VIF | 1/VIF |

|---|---|---|

| FMK | 1.54 | 0.649676 |

| FMA | 1.76 | 0.566991 |

| LC | 1.64 | 0.611536 |

| UIT | 1.16 | 0.860714 |

| ES | 1.08 | 0.925708 |

| GEN | 1.03 | 0.973416 |

| OAGE | 1.12 | 0.895875 |

| EAGE | 1.1 | 0.912754 |

| Mean VIF | 1.3 |

Table 3. Multicollinearity test

Therefore, as indicated from the value of variance inflation factor (VIF), there is no multicollinearity problem.

Heteroscedasticity test: The assumption of homoscedasticity refers to equal variance of errors across all levels of the independent variables (Osborne and Waters 2002). However, it is good to note that the regression is fairly robust to violation of this assumption (Keith 2006). Therefore, in order to solve this problem the researcher was applied robust regression.

Model specification test (Omitted variable test): The stata output indicated that there is no omitted variable (model specification error) since Ramsey test indicates p-value of 0.2389 which is above 0.05. Therefore, the model is specified correctly (Table 4).

| Ov test |

|---|

| Ramsey RESET test using powers of the fitted values FMP |

| Ho: model has no omitted variables |

| F (3,344)=1.41 |

| Prob>F=0.2389 |

Table 4. Model specification test using omitted variable test

Model summary and regression result

The goodness fit of the model is tested using R square. The value of R-square statistics of the model was 60.52%. This value indicated that 60.52% of variation in the dependent variable (FMP) is described by the independent (explanatory) variables and the other 39.48% was explained by other factors which are not involved in this model. Moreover, F value of 0.000 indicates that it is significant supporting the model pertinent to the study (Table 5 and 6).

| reg FMP FMK FMA LC UIT ES GEN OAGE EAGE, robust | |

|---|---|

| Number of observations | 356 |

| F(8,347) | 63.72 |

| Prob>F | 0.000 |

| R-Squared | 0.6052 |

| Root MSE | 5161 |

Table 5. Model summary

| FMP | Coefficient | Robust Std. Err. | t | P>|t| | (95% Conf. interval) | |

|---|---|---|---|---|---|---|

| FMK | 0.4468479 | 0.051054 | 8.75 | 0.000* | 0.3464332 | 0.547263 |

| FMA | 0.2477823 | 0.040781 | 6.08 | 0.000* | 0.1675743 | 0.32799 |

| LC | 0.10182 | 0.03991 | 2.55 | 0.011** | 0.0233245 | 0.180315 |

| UIT | 0.0810066 | 0.038755 | 2.09 | 0.037** | 0.0047823 | 0.157231 |

| ES | 0.1713805 | 0.051608 | 3.32 | 0.001* | 0.0698812 | 0.27288 |

| GEN | -0.0320187 | 0.055288 | -0.58 | 0.563 | -0.1407599 | 0.076722 |

| OAGE | -0.0325568 | 0.031134 | -1.05 | 0.296 | -0.093792 | 0.028678 |

| EAGE | 0.0088084 | 0.011014 | 0.8 | 0.424 | -0.012855 | 0.030472 |

| Cons | -0.6115809 | 0.234609 | -2.61 | 0.01 | -1.073016 | -0.15015 |

Note: *significant at 1% and **significant at 5% level of confidence

Table 6. Regression result

Financial management knowledge

Financial management knowledge has a positive and statistically significant influence on financial management practice with a positive coefficient of 0.4468479 and significant at 1% significance level (p-value=0.000). The result indicates that an increase (decrease) in financial management knowledge of owners/managers results an increase (decrease) in the financial management practice of micro and small enterprises. This implies that lack of financial management knowledge combined with uncertainty of the business environment often leads SMEs to face serious problems regarding financial and overall performances, which can even threaten the survival of the enterprise (Alpkan and Kaya, 2012). This result is consistent with (Thi, et al 2015) which indicated that financial knowledge has positive and significant effect on financial management practice because the role of education with related to financial knowledge will increase insight about financial management practice and an increase in financial knowledge would lead an increase in responsibility of financial management practice. In addition, Joo (2009, as cited in Nyaga, 2016) stated that effective financial management skills should improve financial well-being in a positive way and failure to manage finances well can lead to long term negative social consequences.

Financial management attitude

Financial management attitude has a positive and statistically significant influence on financial management practice with a positive coefficient of 0.2477823 and significant at 1% significance level (p-value=0.000). The result indicates that an increase (decrease) in financial management attitude of owners/managers results an increase (decrease) in the financial management practice of micro and small enterprises. Meaning that the more individuals able to apply a good financial attitude, it also has a good effect on the management of business finance. That means a more positive in financial attitude, the more responsible in financial management practice. This is due to the quality of the financial attitude derived from the quality of good education of a person and able to apply in everyday life (Listianis, 2017, Prihartono and Asandimitra 2018). People with stronger perceptions and positive financial attitudes tend to more successful in financial management (Joo and Grable 2004). Therefore, Individuals express different beliefs about financial management but according to this study and other previous researcher’s owners/managers having strong financial attitude leads to good financial management practice. This fact is supported by (Furnham 1984) stated that financial attitude shape the way people spend, save, and waste money.

Locus of control

Locus of control has a positive and statistically significant influence on financial management practice with a positive coefficient of 0.10182 and significant at 5% significance level (p-value=0.011). The result indicates that an increase (decrease) in locus of control results an increase (decrease) in the financial management practice of micro and small enterprises. This result is in line with the better locus of control a person the better pattern of financial management behavior is caused by internal locus of control is more important because individuals who still earn income from other people then the individual will be more careful and control its expenditure in accordance with the needs so as not spend money on every day/month and can be said that the locus of control have a significant positive effect on financial management behavior (Listiani 2017). By contrast, this result is not in line with indicated that locus of control has a significant negative effect on financial management behavior (Thi, et al 2015). This implies that someone with good locus of control tends not to apply good financial management practice.

Use of information technology

Use of information technology has a positive and statistically significant influence on financial management practice with a positive coefficient of 0.0810066 and significant at 5% significance level (p-value=0.037). The result indicates that an increase (decrease) in use of information technology results an increase (decrease) in the financial management practice of micro and small enterprises. This implies the higher micro and small enterprises will use information technologies, their financial management practice will effective. This result is consistent with (Buhimila and Dong 2018, Agyei-Mensah 2011) stated that the availability of affordable computers and suitable software has played an important role in promoting the practice of sound financial management. In addition, (McChlery, et al 2005) also identified that the use of computerized accounting system as a major factor in promoting sound financial management.

Enterprise size

Size of enterprise is used as a factor of financial management practice and measured by the logarithms of total assets. Size of enterprise has a positive and statistically significant influence on financial management practice with a positive coefficient of 0.1713805 and significant at 1% significance level (p-value=0.001). The result indicated that an increase (decrease) in size of enterprises in the aspect of assets results an increase (decrease) in the financial management practice of micro and small enterprises. The result is in line with (Rathnasiri 2015) study determined that there is statistically significant differences between the category of small and medium scale SMEs in adopting financial management practices. Financial management practice increases as an entity progresses from small to medium size. Therefore, the study revealed that enterprise size has positive influence on financial management practice (Everaert, et al 2006).

Based on the descriptive analysis result, the researcher concluded that there was no adequate financial management training, there is a problem of follow up and expert support, over and under spending of money, problem of record keeping of transactions, inadequate and incompetent accountants, lack of proper planning of resources, pricing goods and services reasonably, segregation of duties, conducting internal audit, no efficient/well organized control over business finance/money, income, expense and savings and preparing, analyzing and distributing financial statements in micro and Small enterprises of East Gojjam Zone. Moreover, owners/managers have not enough financial management knowledge; do not use information technologies such like computers; do not worry about the length of time to pay off debts, do not matter about the amount of money deposited per day; do not worry about working capital management, fixed asset management, and making financial analysis and reporting. However, Owners/managers have good financial management attitude about the need to record transactions daily; written budget essential for effective financial management; written financial goals help to determine priorities in spending but they do not practice in actual. Due to the above problems or reasons there is poor/weak financial management practice in micro and small enterprises of East Gojjam Zone.

The regression result indicted that financial management knowledge, financial management attitude and size of enterprise have statistically significant influence on financial management practice at 1% significance level (p-value=0.000 and 0.001). On the other hand, locus of control and use of information technology have statistically significant influence on financial management practice at 5% significance level since the p values for the two variables were 0.011 and 0.037 respectively. However, gender, owner’s age, and enterprise age were not statistically significant effect on financial management practice since p-value of those three variables are 0.563, 0.296 and 0.424 respectively. Based on the above result the researcher recommends that financial management training is important to improve financial management knowledge and hence practice of owners/managers. Therefore, the government should continuously provide financial management training for micro and small enterprise owners/managers. In addition, using information technology is very important for effective financial management practice. Information technologies (computers) are used to easily record transactions, used to prepare, analysis and report financial statement to users, and store relevant information for long period of time. Therefore, owners/managers of micro and small enterprises should use information technologies to improve their financial management practice. Reading makes human beings good viewers for things and knowledge can be improved through reading. Therefore, owners/manager of micro and small enterprises should improve their financial management knowledge by reading different financial management texts or by acquiring formal/informal educations from different educational institutions.

The limitation of this study is the usage of only primary data. Therefore, future researchers should considered this limitation and it is better to conduct a research on the same title by adding new variables like level of education, experience of the owners/managers, rules and regulations etc. It is also advisable to conduct a research on the same title in households, banks, universities and other public organizations in Ethiopia

[Google Scholar] [Pubmed]

[Crossref] [Google Scholar] [Pubmed]